Are Moving Expenses Tax Deductible? Everything You Need to Know

It’s that special time of the year — tax time. And no one wants to miss out on tax deductions.

You recently moved and want to know, are moving expenses tax deductible?

Continue reading this guide to learn if you are qualified to report moving expense deductions on your Federal Tax Income Return and State Tax Income Return.

Table of Contents

- Are Moving Expenses Tax Deductible on Your Federal Income Tax Return?

- Qualifications for Military Members

- Qualifications For Eligible Civilians

- What Type of Moving Expenses Are Tax Deductible?

- What Type of Moving Expenses Are NOT Tax Deductible?

- How to Claim a Moving Expense Deduction on Your Federal Income Tax Return

- How to Claim a Moving Expense Deduction on Your State Income Tax Return

- 7 States Where You Can Deduct Moving Expenses on Your State Income Tax Return

- Are You Planning a Move in 2021? Let Us Help

Are Moving Expenses Tax Deductible on Your Federal Income Tax Return?

Thanks to the Tax Cuts and Jobs Act (TCJA) being passed in 2017, most people do not qualify for tax deductions on moving expenses.

However, there are some exceptions to this rule. Military members and civilians with hyper-specific qualifications can file moving expenses as tax deductions on their federal income tax return.

Qualifications For Military Members

If you’re an active-duty military member and you are subject to a permanent change of duty station (PCS), you can claim moving expense deductions for the year of 2018 and on whether you are:

- Moving from your home to your first duty station

- Moving from one duty station to another; or

- From your final duty station to your new residence.

When it comes to claiming moving expenses on your federal income tax return, there are a few rules to note:

- There’s no double-dipping allowed. You cannot claim any moving expenses that are reimbursed by the government.

- If you are moving due to the end of your duty, you only have one year to claim your moving expenses on your tax return.

Moving expenses associated with all of the members of your household qualify for tax deductions. In the event that you become deceased, imprisoned, or desert your post, your dependents can claim the moving expense deduction if they have to relocate without you.

Qualifications For Eligible Civilians

If you moved in 2017, you may be in luck.

Since the Tax Cuts and Jobs Act (TCJA) went into effect for 2018 tax filings and beyond, you can still amend your 2017 income tax return if you moved the same year and meet the specific qualification requirements.

If you qualify, you have three years from the date you filed your 2017 federal income tax return or two years from the date you last paid taxes on your 2017 return to amend it.

To claim the moving expense deduction, you must pass these three tests:

- “Closely related to starting work” test

- Time test

- Distance test

Closely Related to Starting Work

Test

To qualify for the moving expense deduction, you must have moved within one year of starting a job at your new location.

There’s only one exception to this rule: If you worked outside of the U.S. and relocated back to the United States to retire, you can pass this test without getting a job at your new location.

Distance Test

In addition to starting a new job, your job location must be 50 miles farther from your former home than your previous job was.

For example, say you lived in San Antonio, Texas, and had a 15-mile work commute before moving to Los Angeles, California. The distance from your previous home in San Antonio to your new job location in Los Angeles is roughly 1,300 miles.

Because 1,300 miles is farther than 50 miles farther than your 15-mile commute, you passed the distance test.

Time Test

The length of your employment at your new location is also a defining factor on whether or not you qualify for the moving expense deduction.

In order to pass this test, you must meet one of the following requirements:

- During the first 12 months following your move, you worked as a full-time employee for at least 39 weeks.

Or

- During the first 12 months following your move, you worked as a full-time self-employed person for at least 39 weeks and you worked at least 78 weeks within a 2-year period.

What Type of Moving Expenses Are Tax-Deductible?

If you qualify for a tax deduction on your move, you may be wondering what type of moving expenses are tax-deductible.

The following moving expenses are tax-deductible:

- Services from a professional moving company

- DIY moving trucks or pods

- The cost of fuel or the standard moving mileage rate, if you travel by car

- Packing supplies

- Move insurance

- Moving help

- Travel expenses (excluding meals) for a one-way trip for each of your household members

- Storage for up to 30 days after household items are moved

What Moving Expenses Are NOT Tax-Deductible?

Unfortunately, not all moving expenses are tax-deductible.

Here’s a list of moving expenses that you can not deduct on your income taxes:

- Any costs associated with buying or selling a home

- Lease expenses and security deposits

- Driver’s license and automobile registration

- Storage charges incurred after your arrival to your new place of residence

- Any expenses incurred from returning to your formal place of residence, for any reason

You cannot claim a deduction on any moving expenses that were reimbursed by your employer. Any moving allowances provided by your employer will also be treated as taxable income on your W-2.

However, this exclusion is not unbeknownst to employers. If you are preparing for a move for your career soon, you can negotiate a larger relocation allowance to help cover tax implications. Just be sure to keep detailed records and receipts of expenses incurred during your move.

How to Claim a Moving Expense Deduction on Your Federal Income Tax Return

To claim a moving expense deduction on your tax return, you need to fill out a Form 3903. On this form, all of your moving expenses are calculated and recorded.

The total from your Form 3903 will then need to be recorded on your Form 1040.

Sounds simple enough, right?

Consulting with a tax advisor is the best way to ensure that your forms are filled out correctly and you receive your maximum amount for deductions.

How to Claim a Moving Expense Deduction on Your State Income Tax Return

There is no set procedure for claiming a moving expense deduction on state income tax returns. The process of claiming these deductions will vary state by state.

Unfortunately, some states have followed in the footsteps of the Tax Cuts and Jobs Act (TCJA) and do not allow deductions for moving expenses.

Let’s take a look at some of the remaining states that will let you claim a moving expense deduction on your state income tax return.

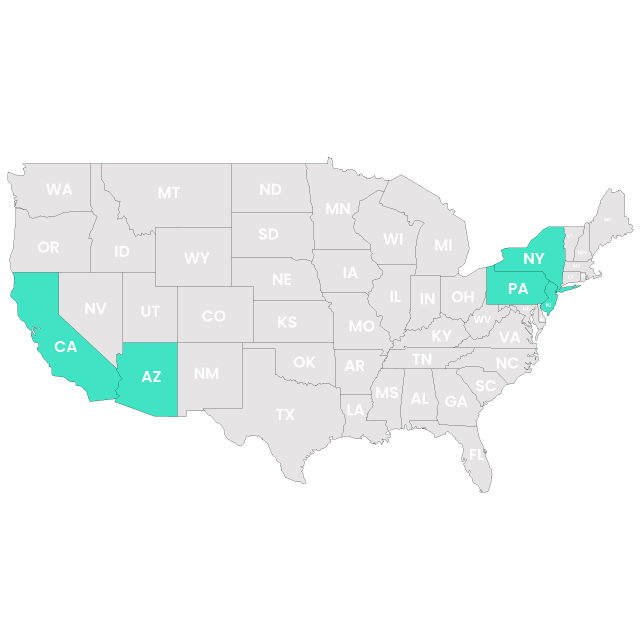

7 States Where You Can Deduct Moving Expenses on Your State Income Tax Return

There are 7 states that will allow you to deduct moving expenses on your state income tax return:

- Arkansas

- California

- Hawaii

- Massachusetts

- New Jersey

- New York

- Pennsylvania

Each state has its own rules for claiming moving expense deductions. Let’s briefly go over the different rules for claiming moving expenses in each state.

#1: Arkansas

As long as you are an employee or self-employed person that moved for your employment and added at least 50 miles in distance from your old home to your new workplace, you can deduct certain moving expenses on your Form AR3903.

#2: California

In California, you can deduct moving expenses on your state tax return as long as you meet the following requirements:

- You pass the distance and time tests

- Your expenses were not reimbursed by your employer

However, there is one workaround on deducting reimbursed expenses. If the moving expense reimbursements from your employer were included as part of your compensation or salary, you can claim deductions on your moving expenses regardless.

#3: Hawaii

To file moving expense deductions on your Hawaii state income tax return, you need to fill out a Form N-139.

Like most states, you must meet the qualifications of the distance and time tests to receive moving expense deductions.

#4: Massachusett

If you pass the distance and time tests, you can file moving expense deductions reported on your U.S Form 1040 Schedule 1. This amount must be entered on either Mass Form 1 or Form 1-NPR/PY Schedule Y.

#5: New Jersey

As long as you meet the requirements, you can claim deductions on your moving expenses in New Jersey by filling out a Form NJ-1040.

#6: New York

If you meet the qualifications for claiming deductions on your moving expenses, you can file for deductions on your New York State Tax Return.

New York now only allows you to claim a moving expense deduction, and excludes qualified employer moving expense reimbursements from income on your tax return.

#7: Pennsylvania

In Pennsylvania moving expenses can only be reported as Unreimbursed Employee Business Expenses. These expenses are claimed on the PA Schedule UE.

In order to claim a moving expense deduction, your move must be deemed necessary for the convenience of your employer, and you must pass the state’s distance test.

Are You Planning a Move in 2021? Let Us Help

When it comes to moving, taxes aren’t the only thing you need to worry about. You need an experienced, reliable moving company to ensure a safe, smooth move to your new home.

At Next Moving, we offer moving services to facilitate any type of move, local or long distance. You can rest assured that your belongings will be in good hands with our highly trained and never subcontracted team of movers.

Call us today for a free quote on your upcoming move.

Note: This article is not a substitute for tax or legal advice. State and federal laws are subject to change and the information presented may not reflect your state’s laws or recent changes to laws. For current tax or legal advice, please consult with an accountant or professional tax advisor.